Online Loans Made Easy: Your Ultimate Option for Urgent Cash Money Demands

Online fundings have actually arised as a viable option for individuals encountering urgent money needs, supplying a structured process that guarantees efficiency and ease of access. The advantages and possible risks of online car loans create a compelling landscape that necessitates expedition for any person looking for economic aid in times of seriousness.

Benefits of Online Loans

Online car loans provide a hassle-free and effective way for people to access monetary support without the demand for standard in-person interactions. One of the main benefits of on-line car loans is the speed at which they can be processed. Unlike traditional financings that may take weeks to approve, online loans often provide instant choices, enabling customers to resolve their monetary requirements without delay. This quick turnaround time can be particularly beneficial in emergency situation scenarios where immediate accessibility to funds is crucial.

Another benefit of online loans is the convenience of application. Customers can finish funding applications from the comfort of their very own homes, getting rid of the need to see a physical bank or monetary organization.

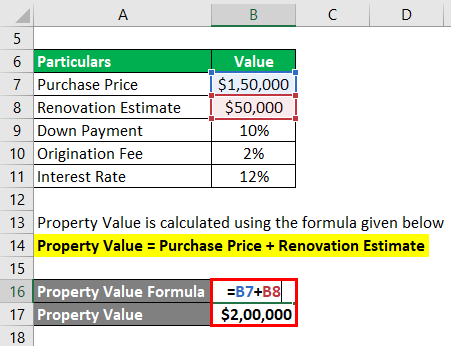

Qualification and Application Refine

Rapid Authorization and Dispensation

Efficient authorization processes and rapid dispensation of funds are essential features of on-line fundings that cater to the prompt monetary needs of consumers. Unlike typical bank lendings that might take weeks to process, on-line loan providers make use of sophisticated technology to enhance the approval process.

Contrast With Typical Lending

In contrast to the structured authorization procedures and quick fund disbursement seen in online financings, traditional financing techniques commonly involve more prolonged application processing times and financing hold-ups. When obtaining a funding with typical methods, such as banks or lending institution, borrowers often face a tedious process that includes submitting comprehensive documents, offering collateral, and going through comprehensive credit report checks. This can cause days or perhaps weeks of awaiting authorization and see this website ultimate dispensation of funds, which might not be optimal for individuals in urgent need of cash money.

Additionally, standard loan providers have a tendency to have stricter qualification standards, making it challenging for individuals with less-than-perfect credit rating or those doing not have considerable possessions to secure a car loan - personal loans calgary. On the other hand, online lending institutions, leveraging modern technology and alternate data resources, have actually made it possible for a wider series of debtors to access fast and easy funding remedies. By simplifying the application process and accelerating approval times, on the internet car loans offer a hassle-free option to conventional borrowing for those seeking instant monetary assistance

Tips for Accountable Loaning

When thinking about obtaining money, it is vital to approach the procedure with mindful consideration and monetary mindfulness. Here are some ideas to make certain accountable loaning:

Assess Your Demand: Prior to getting a financing, evaluate whether it is a need or a desire. Avoid borrowing for non-essential expenses.

Borrow Just What You Can Pay Back: Calculate your payment capability their website based upon your revenue and expenditures. Borrow only a quantity that you can pleasantly repay without straining your financial resources.

Recognize the Terms: Review and recognize the terms of the loan agreement, including rate of interest, costs, and settlement routine (online loans alberta). Make clear any kind of doubts with the loan provider before continuing

Contrast Lenders: Study and contrast offers from different lending institutions to locate one of the most positive terms. Try to find reliable lenders with transparent techniques.

Prevent Several Car Loans: Refrain from taking numerous financings simultaneously as it can bring about a financial debt blog spiral. Prioritize paying off existing financial debts before considering brand-new ones.

Final Thought

To conclude, online financings use a practical and fast option for urgent cash money requirements. By providing very easy access to funds, streamlined application procedures, and quick approval and disbursement, on-line fundings can be a reputable option for those encountering monetary emergencies. Nonetheless, it is essential for borrowers to work out responsible loaning practices to stay clear of coming under financial obligation traps and financial troubles in the future.